geothermal tax credit canada

In a massive environmentally-focused year-end bill congress announced on December 21 2020 that they would extend its federal tax credit for residential ground source heat pumps GSHP installed before 12312022. 2373 CRCE treatment will be available for expenses in geothermal projects only.

Geoscan Search Results Fastlink

Great news the Federal Investment Tax Credit ITC for geothermal has been extended through 2023.

. A 10 tax credit on the purchase and. Free for Geothermal Canada members see member email for promocode. The Government of Canada has implemented certain tax measures to help Canadian families when they renovate.

Geothermal - a 75 tax credit on the purchase of a geothermal heat pump and a 15 tax credit on the cost of. Work from Home Expenses. In 2019 the tax credit was renewed at 30 of the total system cost which dropped to 26 in 2020.

Geothermal is officially designated as a renewable energy by Natural Resources Canada NRCan. Geothermal is not only an environmentally friendly way to heat and cool in Alberta it can also yield. 150 to 2500 for ductless mini-split geothermal centrally-ducted and air-to-water systems.

A 30 tax credit for the installation of a ground source heat pump geothermal system with no cap was enacted in 2009. The 26 credit applies to geothermal equipment placed in service through 2022. The ITC extension will allow homeowners who install a geothermal heat pump to deduct 26 of the cost of the system from their federal income taxes in 2022 and 22 in 2023.

The American Recovery and Reinvestment Act adopted in October 2008 allows for a 26 tax credit for costs associated with ENERGY STAR qualified geothermal heat pumps installed in residences as noted in section 25D of the Internal Revenue Code. Ontario Rebates and Incentives. Efficiency Nova Scotia currently has a number of heating system rebates available to Nova Scotians and they include.

The Green Energy Equipment Tax Credit has been expanded to include biomass fuel energy equipment that is installed in Manitoba and used in a business. The Manitoba Tax Assistance Office Manitoba Finance 110A - 401 York Avenue Winnipeg MB R3C 0P8 Telephone. Includes 78 clean energy rebates grants tax credits and forgivable loans.

The Geothermal Tax Credit covers expenses including labor onsite preparation assembly equipment and piping or wiring to connect a system to the home. A very popular credit that was introduced by the CRA since 2020 after the surge in remote work with the pandemic is the work from home tax credit. Get Special Innovation Funds Find Canadas Tax Credits To Help Your Business Thrive.

This Tax credit was available through the end of 2016. Geothermal Canada is a not-for-profit organization committed to advancing science and promoting geothermal research and development in Canada. The tax credit rate is 15.

Geothermal Heating Systems for Homes Domestic Geothermal heating systems can be a great way to heat a home replace a furnace and are labeled as money savers. Geothermal heat pumps are similar to ordinary heat pumps but use the ground instead of outside air to provide heating air conditioning and. Ultimately the tax credit was reinstated in early February 2018.

This Tax credit was available through the end of 2016. If the federal tax credit exceeds tax liability the excess amount may be carried forward into future years. A 30 tax credit for the installation of a ground source heat pump geothermal system with no cap was enacted in 2009.

Manitoba residents who install a new geothermal or solar heating system can receive a Green Energy Equipment Tax Credit. The 26 federal tax credit was extended through 2022 and will. Homeowners who install geothermal can get the tax credit simply by filling out a form declaring the amount you spent when you file your federal income taxes.

The tax credit currently stands at 26 percent throughout 2021 and 2022 before decreasing to 22 percent in 2023. Complete list of clean energy rebates and incentives in Canada. Spending on geothermal heat pump property adds to your homeâs cost basis but also must be reduced by.

The credit will lower to 22 in 2023 and for commercial. Geothermal Canada is a not-for-profit organization committed to advancing science and promoting geothermal research and development in Canada. Geothermal Canada is a not-for-profit organization committed to advancing science and promoting geothermal research and development in Canada.

In Ontario several different groups including Enbridge Gas Distribution Hydro One Independent Electricity System Operator Ontario Electricity Support Program and Toronto Hydro offer rebates and incentives. A grouping of incentives related to energy efficiency from provincialterritorial governments major Canadian municipalities and major electric and gas utilities are offered below. Adjusted cost means an amount equal to 125 of the manufacturers.

Wood and pellet heating. For example Enbridge Gas Distribution offers homeowners up to 2000 to cover the cost of a home. 1 hour agoFort Nelson BC Canada source.

The 26 federal tax credit was extended through 2022 and will drop to 22 in 2023 before expiring altogether so act now for the most savings. As we mentioned before the geothermal tax credit goes through cycles of reinstatement expiration and renewal within the US. The bill was signed into law on December 27 by president Donald Trump.

From 2017 to January of 2018 there was an ongoing fight to extended this tax credit. This program helps consumers save up to 25 on products up to a limit of 500 excluding water heaters and air-source heat pumps which qualify for a rebate of up to 1000. The tax credit can be used to offset both regular income taxes and alternative minimum taxes AMT.

255 The Atlantic investment tax credit applies to the following qualified properties which are. Manufacturers can claim a 75 tax credit on the adjusted cost of geothermal heat pump systems that meet the standards set by the Canadian Standards Association. Chris Shervey flickr Creative Commons carlos Jorquera 5 Jul 2022 Se están realizando pruebas de pozos para evaluar la viabilidad comercial de instalar una planta de energía en el sitio del proyecto geotérmico Tu Deh-Kah BC Canadá.

The LLC owners are in a 40 marginal tax bracket when state income tax is included 2020 Tax Credit. This number will carry through until the end of 2022 and drops to 22 in 2023. Earth energy technology is preferred because it is an environmentally and socially responsible technology with no emissions or harmful components.

As long as your system is up and running by the end of 2022 you can claim. Ad Contact Us To Find Out How Your Business Can Take Advantage Of Tax Credit Incentives. Federal Budget 2021 proposed a number of measures to facilitate Canadas economic recovery and to promote the manufacture and use of clean energy equipment.

You can claim this credit if you manufacture and sell geothermal heat pumps for use in Manitoba before July 1 2023. CRA allows all employees who worked from home to claim up to 500 in employment expenses as a flat rate for tax year 2021 up from 400 last year. This extension is a huge incentive for homeowners who.

Free for Geothermal Canada members see member email for promocode. For information on this tax credit contact. Green Energy Equipment Tax Credit The Government of Manitoba currently offers a tax credit for geothermal heat pump systems 75 15 and solar thermal energy systems 10.

Serving Canadas geothermal community by stimulating technology transfer knowledge exchange and information transmission it seeks to promote innovation in Canada in the field of. The maximum tax credit for fuel cells is 500 for each half-kilowatt of power capacity or 1000 for each kilowatt. Some examples of ENERGY STAR certified products.

Looking to Make the Process of Claiming Tax Credits Less Costly and Time-Consuming.

Ohio Jess Ohio Map Ohio Fremont Ohio

Annex 6 Tax Measures Supplementary Information Budget 2021

U S And Canada S Power Refining Industries Adjust After 2020 Headwinds Phcppros

Best Grants For Solar Panels In Canada

Annex 6 Tax Measures Supplementary Information Budget 2021

Canada Shadow Economy Data Chart Theglobaleconomy Com

![]()

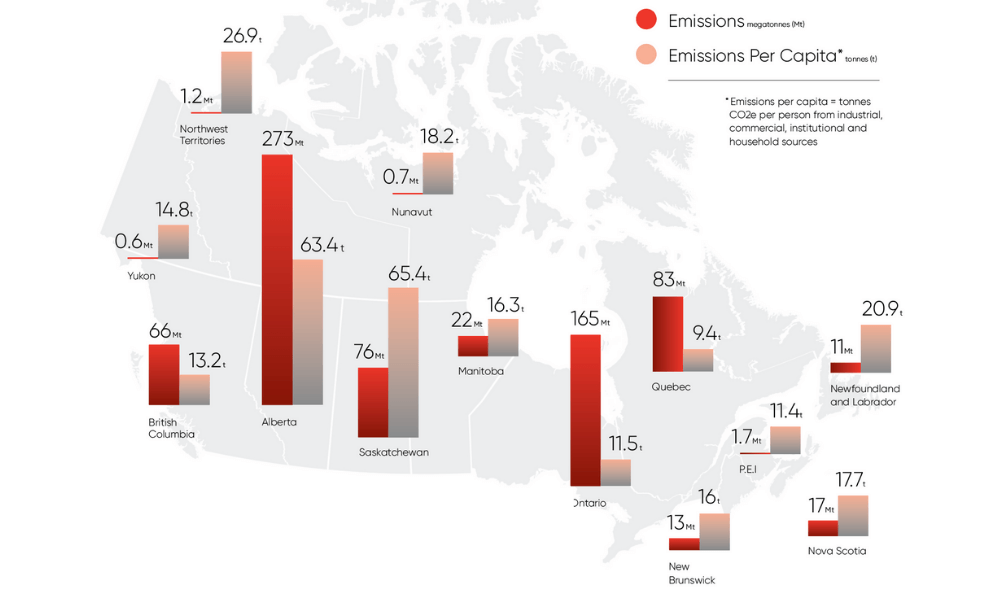

Net Zero Report Card How Future Friendly Are Canadian Provinces Corporate Knights

Geoscan Search Results Fastlink

Image Copyright Thinkstock Image Caption Pinterest

National Atlas Print Your State Great For Cards Kids Flashcards Collage More Tennessee Tennessee Geography For Kids Tennessee Map

Geoscan Search Results Fastlink

Renewable Energy Country Attractiveness Index Us Dropped From 1st To 3rd The Full Pdf Is Avail Vi Renewable Energy Solar Energy Projects Solar Energy Facts

One Argument Some People Make Against Renewable Resources Is That They Cost More To Produce Than The Non R Nonrenewable Resources Alternative Energy Wind Power

Constructive Dismissal At Ocean Nutrition The Cape Breton Spectator

Canada Shadow Economy Data Chart Theglobaleconomy Com

The Canadian Manifesto Sutherland House Publishing

Recorrido Del Rio Hudson Lake Ontario City Island Lake Huron

Net Zero Report Card How Future Friendly Are Canadian Provinces Corporate Knights